Wide World of Growth

Investors often show a home country bias, tending to invest heavily within their own nations. Is there a broader world of growth to explore beyond U.S. borders?

Investors around the world typically display some amount of

home country bias, where they invest disproportionately in the country in which they live. This problem may be particularly acute for U.S. investors who could assume that opportunities for growth equities outside of the country are limited. Is there a wide world of growth beyond U.S. borders?

- The U.S. has been the epicenter of corporate growth and innovation for decades, making significant contributions to the personal computer, internet, smartphone, and potentially leading the world in artificial intelligence (AI) given its momentum in hardware and software development. Over the past 20 years, S&P 500 EPS has grown over 200%, more than double that of the MSCI All Country World ex-US Index as of December 2024. However, this does not mean that all great growth companies are based in the U.S. We believe there are a plethora of fast-growing international companies that many U.S. investors may be overlooking.

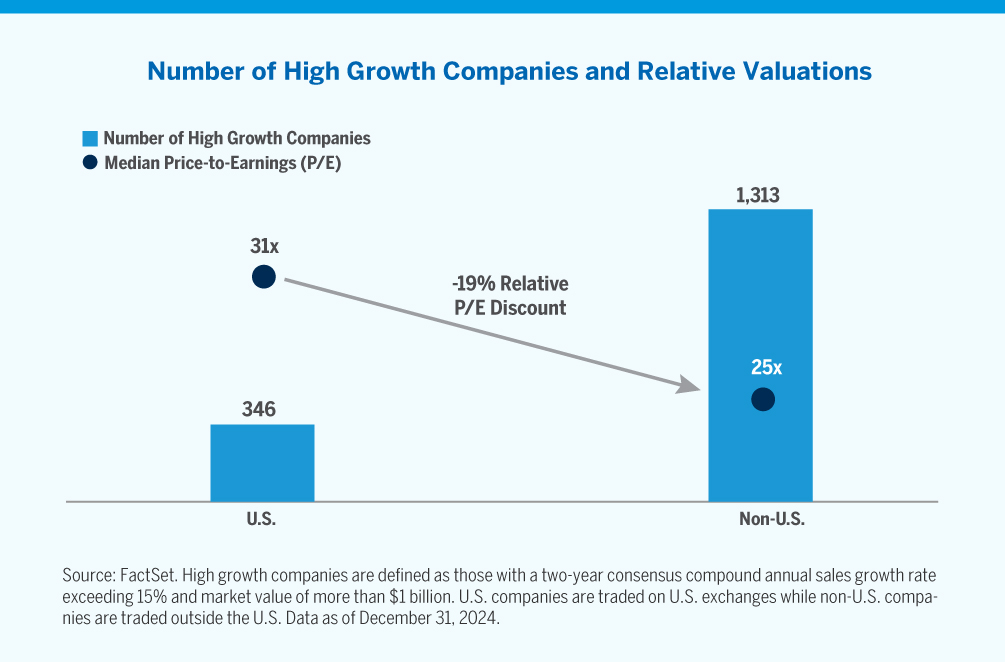

- As the chart above shows, there are nearly four times as many high-growth companies–defined as those with a two-year consensus sales growth exceeding 15% annually—trading outside the U.S. as there are within. As one might expect, non-US high-growth companies are predominantly found in the technology and healthcare sectors; however, there is also a meaningful representation in the industrials and materials sectors. While we continue to see potentially compelling opportunities within the U.S., valuations for non-U.S. high-growth stocks appear attractive, with a median price-to-earnings ratio 19% lower than U.S. high-growth companies.

- Given these findings and our research indicating that many high-quality growth companies trade beyond our borders, we believe investors may want to examine their allocations and consider searching for high-growth potential outside of the U.S.

The views expressed are the views of Fred Alger Management, LLC (“FAM”) and its affiliates as of January 2025. These views are subject to change at any time and may not represent the views of all portfolio management teams. These views should not be interpreted as a guarantee of the future performance of the markets, any security or any funds managed by FAM. These views are not meant to provide investment advice and should not be considered a recommendation to purchase or sell securities.

Risk Disclosures: : Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Foreign securities and Emerging Markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility.

Past performance is not indicative of future performance. Investors whose reference currency differs from that in which the underlying assets are invested may be subject to exchange rate movements that alter the value of their investments.

Companies involved in, or exposed to, AI-related businesses may have limited product lines, markets, financial resources or personnel as they face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing their consumer base. These companies may be substantially exposed to the market and business risks of other industries or sectors, and may be adversely affected by negative developments impacting those companies, industries or sectors, as well as by loss or impairment of intellectual property rights or misappropriation of their technology. Companies that utilize AI could face reputational harm, competitive harm, and legal liability, and/or an adverse effect on business operations as content, analyses, or recommendations that AI applications produce may be deficient, inaccurate, biased, misleading or incomplete, may lead to errors, and may be used in negligent or criminal ways. AI companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology.

Investing in innovation is not without risk and there is no guarantee that investments in research and development will result in a company gaining market share or achieving enhanced revenue. Companies exploring new technologies may face regulatory, political or legal challenges that may adversely impact their competitive positioning and financial prospects. Developing technologies to displace older technologies or create new markets may not in fact do so, and there may be sector-specific risks. There will be winners and losers that emerge, and investors need to conduct a significant amount of due diligence on individual companies to assess these risks and opportunities.

Important Information for US Investors: This material must be accompanied by the most recent fund fact sheet(s) if used in connection with the sale of mutual fund and ETF shares. Fred Alger & Company, LLC serves as distributor of the Alger mutual funds.

Important Information for UK and EU Investors: This material is directed at investment professionals and qualified investors (as defined by MiFID/FCA regulations). It is for information purposes only and has been prepared and is made available for the benefit investors. This material does not constitute an offer or solicitation to any person in any jurisdiction in which it is not authorized or permitted, or to anyone who would be an unlawful recipient, and is only intended for use by original recipients and addressees. The original recipient is solely responsible for any actions in further distributing this material and should be satisfied in doing so that there is no breach of local legislation or regulation.

Certain products may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or countries.

Alger Management, Ltd. (company house number 8634056, domiciled at 85 Gresham Street, Suite 308, London EC2V 7NQ, UK) is authorised and regulated by the Financial Conduct Authority, for the distribution of regulated financial products and services. FAM, Weatherbie Capital, LLC, and/or Redwood Investments, LLC, U.S. registered investment advisors, serve as sub-portfolio manager to financial products distributed by Alger Management, Ltd.

Alger Group Holdings, LLC (parent company of FAM and Alger Management, Ltd.), FAM, and Fred Alger & Company, LLC are not authorized persons for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and this material has not been approved by an authorized person for the purposes of Section 21(2)(b) of the FSMA.

Important information for Investors in Israel: Fred Alger Management, LLC is neither licensed nor insured under the Israeli Regulation of Investment Advice, of Investment Marketing, and of Portfolio Management Law, 1995 (the "Investment Advice Law"). This document is for information purposes only and should not be construed as an offering of Investment Advisory, Investment Marketing or Portfolio Management services (As defined in the Investment Advice Law). Services regulated under the Investment Advice Law are only available to investors that fall within the First Schedule of Investment Advice Law ("Qualified Clients"). It is hereby noted that with respect to Qualified Clients, Fred Alger Management, LLC is not obliged to comply with the following requirements of the Investment Advice Law: (1) ensuring the compatibility of service to the needs of client; (2) engaging in a written agreement with the client, the content of which is as described in section 13 of the Investment Advice Law; (3) providing the client with appropriate disclosure regarding all matters that are material to a proposed transaction or to the advice given; (4) a prohibition on preferring certain Securities or other Financial Assets; (5) providing disclosure about "extraordinary risks" entailed in a transaction (and obtaining the client's approval of such transactions, if applicable); (6) a prohibition on making Portfolio Management fees conditional upon profits or number of transactions; (7) maintaining records of advisory/discretionary actions. This document is directed at and intended for Qualified Clients only.

S&P 500® is an index of large company stocks considered to be representative of the U.S. stock market. The S&P indexes are a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Fred Alger Management, LLC and its affiliates. Copyright 2025 S&P Dow Jones Indices LLC, a subsidiary of S&P Global Inc. and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. Investors cannot invest directly in any index. Index performance does not reflect deductions for taxes. The performance data quoted represents past performance, which is not an indication or a guarantee of future results.

The MSCI ACWI ex USA Index (gross) captures large and mid cap representation across Developed Markets (DM) countries (excluding the US) and Emerging Markets (EM) countries. The S&P 500 is an index of large company stocks considered to be representative of the U.S. stock market.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

FactSet is an independent source, which Alger believes to be a reliable source. FAM, however, makes no representation that it is complete or accurate.

Earnings per share (EPS) is the portion of a company's earnings or profit allocated to each share of common stock.

Price-to-earnings is the ratio for valuing a company that measures its current share price relative to its earnings per share.

Alger pays compensation to third party marketers to sell various strategies to prospective investors.

Fred Alger Management, LLC 100 Pearl Street, New York, NY, 10004 / 212.806.8800 / www.alger.com