Is Crypto Finally Growing Up?

While headlines once focused on extreme volatility and illicit activity, a clearer regulatory framework is now emerging. Could regulation finally be catching up to innovation, paving the way for broader adoption?

After years of growing pains, the crypto industry may finally be turning a corner. While headlines once focused on extreme volatility and illicit activity, a clearer regulatory framework is now emerging. Could regulation finally be catching up to innovation, paving the way for broader adoption?

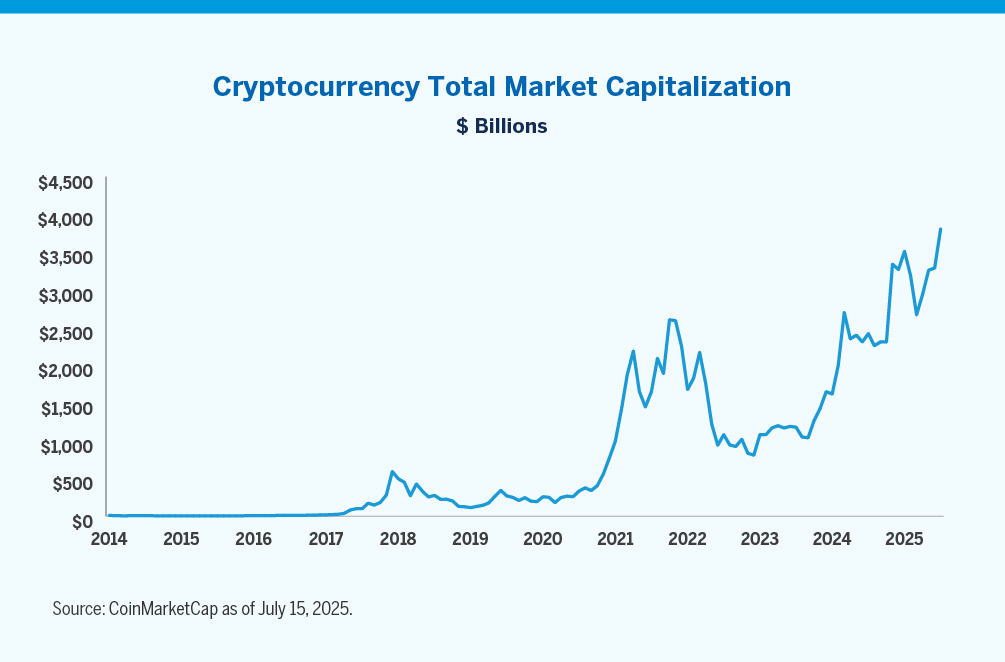

- As shown in the chart above, cryptocurrency’s total market capitalization has soared to approximately $3.8 trillion, reflecting broader adoption over the past decade. Yet, despite its meteoric rise in value, widespread crypto adoption continues to face regulatory uncertainty: Are digital assets securities? What agency oversees them? How can they fit into traditional finance?

- These questions are likely to be answered through legislation. For example, the Digital Asset Market Structure Bill, making its way through Congress, seeks to clarify how digital assets are distinguished from securities and would grant the Commodities Futures Trading Commission authority over digital assets. In a recent speech, SEC Chairman Paul Atkins discussed the potential for traditional securities to move from centralized databases to distributed blockchain databases, comparing the forthcoming shift to when “digital audio revolutionized the music industry” and saying on-chain securities (e.g., trading a stock on a public blockchain ledger) could be more transparent and enhance liquidity.1 Additionally, the U.S. is also set to enact legislation through the GENIUS Act on stablecoins—digital tokens tied to assets like the U.S. Dollar. With annual transaction volumes already reaching $7.3 trillion as of June 30, 2025, stablecoins could potentially broaden out crypto’s appeal by providing a steady store of value or a reliable medium of exchange.2

- In our view, transparent crypto regulation could create attractive opportunities for long-term equity investors. Companies positioned to potentially benefit from a clearer, more supportive regulatory backdrop include those involved in the issuing, trading or custody of digital assets, as well as firms leveraging blockchain technology to facilitate similar activities for traditional securities on-chain.

1Paul S. Atkins, “Keynote Address at the Crypto Task Force Roundtable on Tokenization,” speech, U.S. Securities and Exchange Commission, Washington, DC, May 12, 2025.

2Visa Onchain Analytics. "Adjusted Transaction Methodology," as of 6/30/25. The $7.3 trillion annual adjusted transaction volume represents the total value of genuine economic transactions settled using stablecoins over the past year, excluding internal transfers, repeated wallet movements, and automated trading activities.

The views expressed are the views of Fred Alger Management, LLC (“FAM”) and its affiliates as of July 2025. These views are subject to change at any time and may not represent the views of all portfolio management teams. These views should not be interpreted as a guarantee of the future performance of the markets, any security or any funds managed by FAM. These views are not meant to provide investment advice and should not be considered a recommendation to purchase or sell securities.

Risk Disclosures: Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments.

Investing in innovation is not without risk and there is no guarantee that investments in research and development will result in a company gaining market share or achieving enhanced revenue. Companies exploring new technologies may face regulatory, political or legal challenges that may adversely impact their competitive positioning and financial prospects. Developing technologies to displace older technologies or create new markets may not in fact do so, and there may be sector-specific risks. There will be winners and losers that emerge, and investors need to conduct a significant amount of due diligence on individual companies to assess these risks and opportunities.

Important Information for US Investors: This material must be accompanied by the most recent fund fact sheet(s) if used in connection with the sale of mutual fund and ETF shares. Fred Alger & Company, LLC serves as distributor of the Alger mutual funds.

Important Information for UK and EU Investors: This material is directed at investment professionals and qualified investors (as defined by MiFID/FCA regulations). It is for information purposes only and has been prepared and is made available for the benefit investors. This material does not constitute an offer or solicitation to any person in any jurisdiction in which it is not authorized or permitted, or to anyone who would be an unlawful recipient, and is only intended for use by original recipients and addressees. The original recipient is solely responsible for any actions in further distributing this material and should be satisfied in doing so that there is no breach of local legislation or regulation.

Certain products may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or countries.

Alger Management, Ltd. (company house number 8634056, domiciled at 85 Gresham Street, Suite 308, London EC2V 7NQ, UK) is authorised and regulated by the Financial Conduct Authority, for the distribution of regulated financial products and services. FAM, Weatherbie Capital, LLC, and/or Redwood Investments, LLC, U.S. registered investment advisors, serve as sub-portfolio manager to financial products distributed by Alger Management, Ltd.

Alger Group Holdings, LLC (parent company of FAM and Alger Management, Ltd.), FAM, and Fred Alger & Company, LLC are not authorized persons for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and this material has not been approved by an authorized person for the purposes of Section 21(2)(b) of the FSMA.

Important information for Investors in Israel: Fred Alger Management, LLC is neither licensed nor insured under the Israeli Regulation of Investment Advice, of Investment Marketing, and of Portfolio Management Law, 1995 (the "Investment Advice Law"). This document is for information purposes only and should not be construed as an offering of Investment Advisory, Investment Marketing or Portfolio Management services (As defined in the Investment Advice Law). Services regulated under the Investment Advice Law are only available to investors that fall within the First Schedule of Investment Advice Law ("Qualified Clients"). It is hereby noted that with respect to Qualified Clients, Fred Alger Management, LLC is not obliged to comply with the following requirements of the Investment Advice Law: (1) ensuring the compatibility of service to the needs of client; (2) engaging in a written agreement with the client, the content of which is as described in section 13 of the Investment Advice Law; (3) providing the client with appropriate disclosure regarding all matters that are material to a proposed transaction or to the advice given; (4) a prohibition on preferring certain Securities or other Financial Assets; (5) providing disclosure about "extraordinary risks" entailed in a transaction (and obtaining the client's approval of such transactions, if applicable); (6) a prohibition on making Portfolio Management fees conditional upon profits or number of transactions; (7) maintaining records of advisory/discretionary actions. This document is directed at and intended for Qualified Clients only.

Coinmarketcap is a website that provides information and data such as prices, trade volumes, market capitalization on cryptocurrencies.

Alger pays compensation to third party marketers to sell various strategies to prospective investors.

Fred Alger Management, LLC 100 Pearl Street, New York, NY, 10004 / www.alger.com 800.305.8547 (Retail) / 800.223.3810 (Institutional)