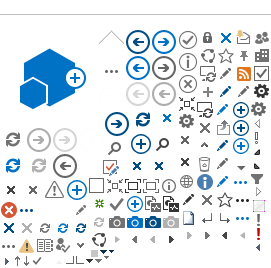

Digital transformation is reshaping industries by integrating advanced technologies that enhance efficiency and foster innovation. An emerging component of this transformation is digital twin technology, which constructs detailed virtual models of physical objects, processes, or locations to serve as real-time digital counterparts.

For example, airlines have used a digital twin of an aircraft to dynamically update and optimize operations based on continuous sensor data.

1 While the concept of digital twins has been around for decades, recent advancements in computing power, network connectivity, cost-effective data storage, deep learning, and cloud computing have significantly increased their utility. Further, digital twins are not standalone technologies; they are part of a comprehensive ecosystem that includes databases, software, and sensors providing continuous feedback (see image 1).

Although public discourse around digital twins has often focused on consumer applications like the Metaverse, where users virtually interact through avatars, these technologies are making significant strides in enterprise settings. Today, companies are utilizing digital twins to fundamentally transform how decisions are made across industries such as construction, real estate, manufacturing, and logistics. Moreover, with advancements in data analytics and computing, companies implementing digital twin technology can now leverage Generative Artificial Intelligence (GenAI)—AI that can analyze and create new data like text, images, videos and 3D models—to help predict outcomes and provide actionable insights. This paper delves into these enterprise applications, exploring how digital twin technology, enhanced by GenAI, is setting the stage for the next wave of industrial innovation.

Construction and Infrastructure

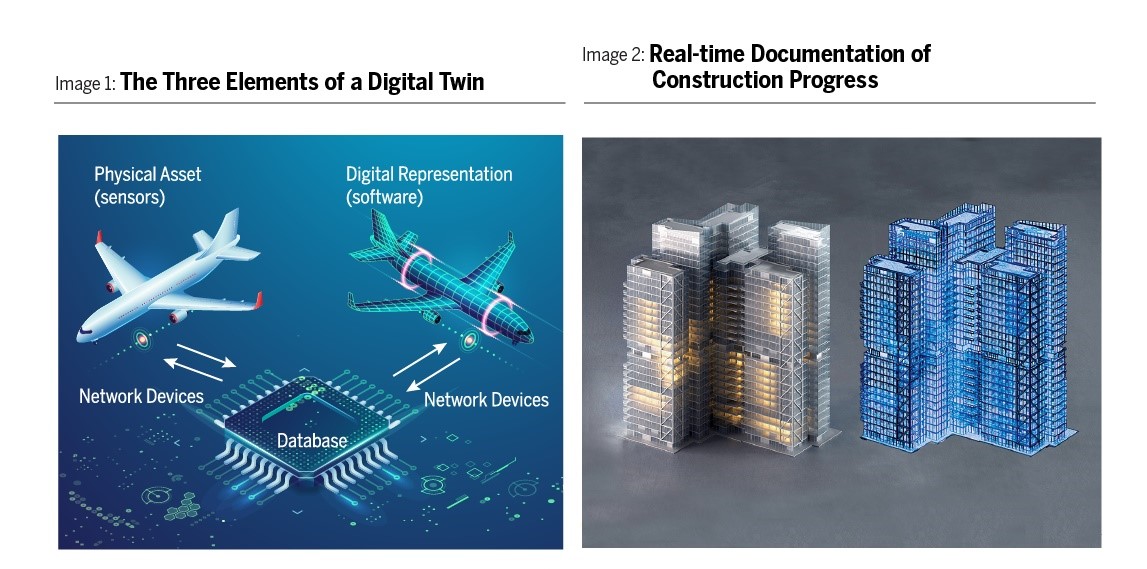

To understand the transformative impact of digital twin technology, we turn first to the construction industry. Historically, construction has been one of the least digitized industries globally, marked by manual regulatory processes and operating inefficiencies. However, companies like Procore, a provider of construction management software, are incorporating the use of digital twin technology to revolutionize how construction projects are managed and executed. By using digital twins, these companies enable real-time documentation and sharing of construction progress, which significantly optimizes workflow and resource management. Procore employs drones and sensors to survey sites, automatically processing the data to generate high-resolution maps, models, and virtual tours (see image 2).

2 This technology not only minimizes the need for onsite visits but also enhances regulatory and contractual compliance, thereby boosting overall project efficiency.

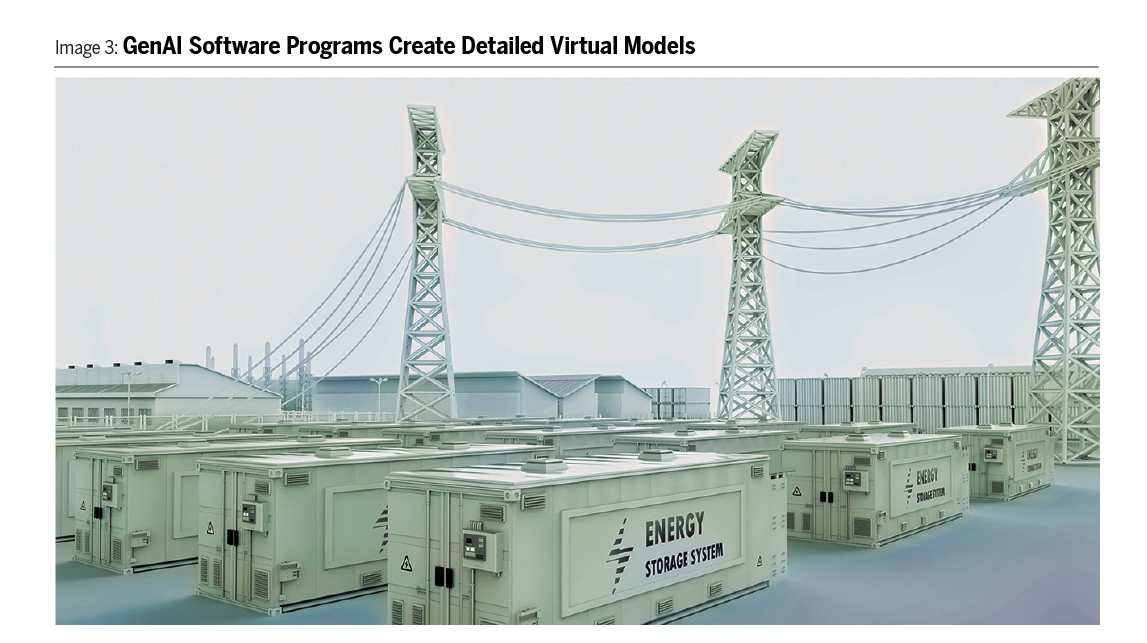

Building on the applications in construction, digital twin technology extends its utility to encompass broader urban and infrastructure projects. Companies like Autodesk utilize this technology for city planning and critical infrastructure monitoring. These companies survey large areas and then feed the data into GenAI software programs to rapidly create detailed virtual models of urban layouts.

3 This enhanced modeling capability allows for the simulation of various environmental scenarios, providing tools to stress test buildings and infrastructure against extreme weather events such as an earthquake or major flooding. For example, a GenAI-enhanced digital twin of an electricity grid could forecast potential bottlenecks in anticipation of an expected heatwave. Such foresight enables utility companies to adjust electricity supply proactively, mitigating the risk of overloads during peak demand periods caused by increased air conditioning use, thus preventing potential power outages (see image 3).

4

Real Estate

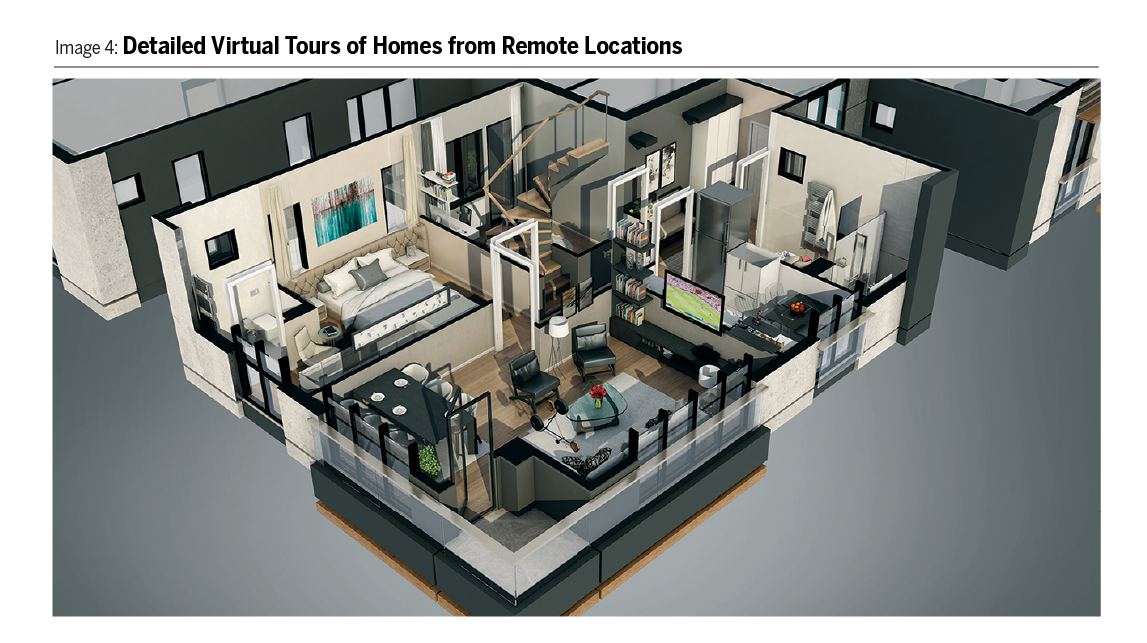

The innovations brought by digital twins in construction and infrastructure pave the way for similar advancements in the real estate sector. Just as digital models streamline project management on construction sites, they also transform property buying and remodeling by providing detailed virtual replicas that potential buyers and developers can explore remotely. Matterport, an AI-powered spatial data platform owned by CoStar Group, uses digital twin technology to create detailed tours and inspections of homes from remote locations, facilitating decision-making without the need for physical visits (see image 4).

5 For remodeling, digital twins also offer homeowners and designers the ability to experiment with different layouts, materials, and designs in a virtual environment before any physical changes are made. This not only ensures that the final design is well-considered but also helps in managing budgets more effectively, reducing the risk and cost associated with trial-and-error methods in physical spaces.

Manufacturing and Logistics

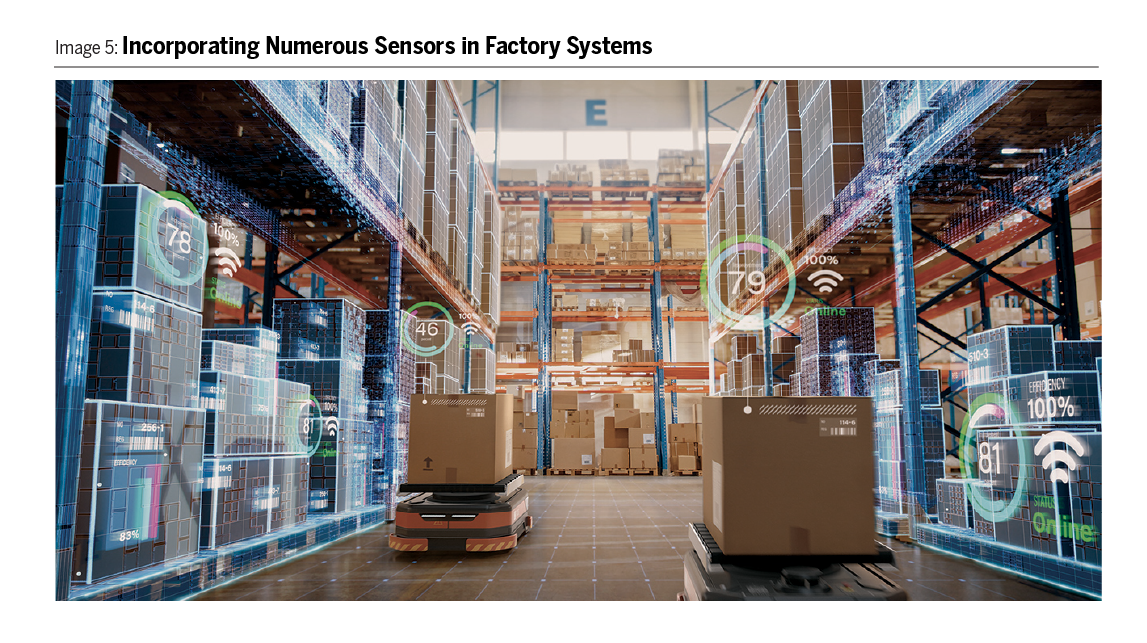

While digital twins revolutionize property management and development, their utility extends beyond real estate. In the manufacturing and logistics industry, the growing complexity of warehousing and logistics has driven the need for innovative tools to enhance efficiency and productivity. To create a digital representation of a warehouse, companies are increasingly relying on sensors to modernize the industry. As more sensors are integrated into factory systems, the demand for connectors that enable continuous digital representations of these facilities grows. Amphenol, a provider of highly engineered connectors that efficiently transmit and receive data, plays a critical role in this process. By incorporating numerous sensors on machine tools and robotics throughout a factory, manufacturing companies can leverage their digital twins to analyze operations in real time and significantly improve efficiency (see image 5).

6

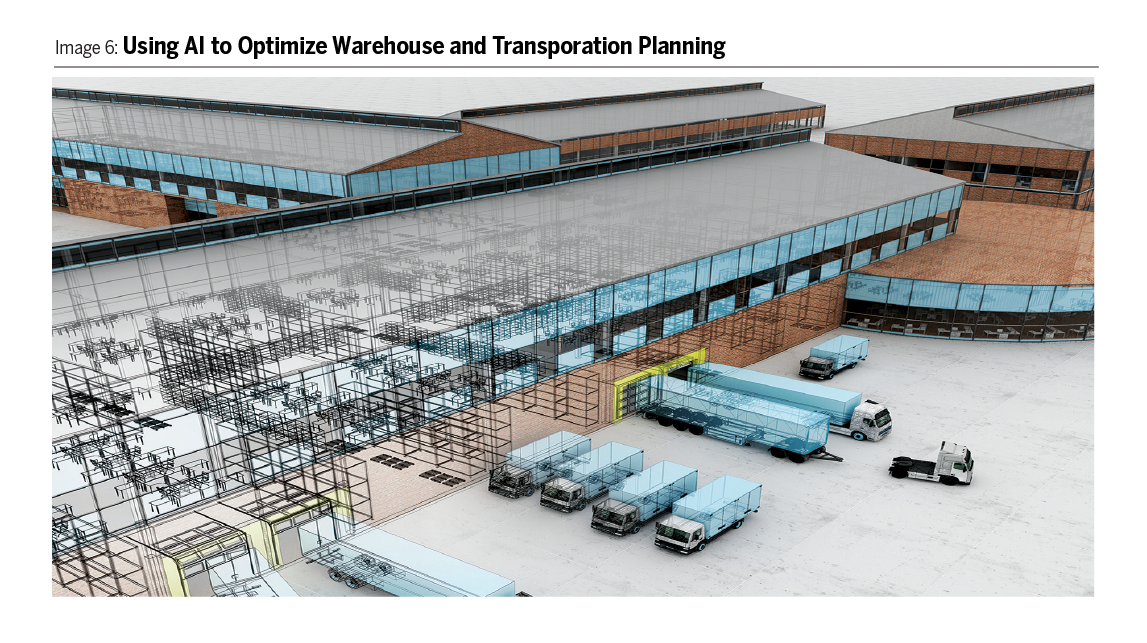

Outside the factory, Manhattan Associates—a leading provider of software solutions designed to manage supply chains, inventory, and omni-channel operations—is leveraging AI to optimize warehouse and transportation planning. Their approach includes a digital twin of the yard—the loading area outside the warehouse—offering real-time insights and updates. This system lets users clearly see the location of every dock and yard area, check the status of trailers, see what they contain, and monitor the progress of goods coming in and going out. As a result, this digital visibility helps optimize the loading and unloading queue, saving time and costs as fewer trailer goods sit idle (see image 6).

7

Leveraging Generative AI and the Path Forward

Digital twin technology, as we have demonstrated, is not confined to a single industry but serves as a versatile tool that enhances decision-making and operational efficiency across various sectors. The real-world applications—from refining construction processes and enabling remote real estate inspections to optimizing manufacturing and logistics—showcase the tangible impact of digital twins on enterprises. Although still in its early stages, the integration of GenAI with digital twins provides intense computational analysis capabilities that could dramatically accelerate digital transformation in the coming decades. As GenAI continues to evolve, we anticipate that digital twin technology could revolutionize fields such as healthcare, where it could predict individual health risks and tailor treatments, thereby significantly shortening clinical trials and reducing R&D costs for biotechnology companies. As these technologies develop further, we believe their synergy could unlock unprecedented opportunities for addressing complex and dynamic global challenges. At Alger, we are enthusiastic about the ongoing integration of digital twin technology and GenAI across industries, where their full transformative potential is yet to be realized.