Over the past several years, artificial intelligence (AI) has dominated media headlines, captured investor attention and rewarded those who were positioned in leading technology companies following the launch of ChatGPT. However, we believe this intense focus on AI may be overshadowing compelling secular themes that are unfolding within the “real economy,” such as reshoring, automation within manufacturing, and power infrastructure modernization.

In this paper, we explore several structural shifts currently reshaping the U.S. economy with a focus mid-cap enablers and potential beneficiaries:

I. Reshoring & The Reemergence of Domestic Manufacturing: Companies increasingly recognize the strategic advantage of bringing manufacturing closer to home.

II. Industrial Automation: As reshoring activity picks up in U.S. manufacturing—especially in national-security-related industries such as semiconductors and pharmaceuticals—investments in automation are projected to rise, helping offset higher domestic labor and production costs.

III. Increased Power Demand: From data centers to increased industrial manufacturing activity, the demand for electricity is projected to rise considerably, driving a meaningful increase in power infrastructure investments.

Collectively, these three themes have enhanced the economic and political “return on proximity” across numerous sectors, a dynamic we believe should persist irrespective of political shifts in Washington. Companies are reassessing both direct costs (e.g., labor, logistics) and indirect costs (e.g., intellectual property concerns, supply chain disruptions), driving a lasting wave of domestic capacity modernization that spans factories and power infrastructure. In our view, this structural shift presents compelling long-term opportunities, particularly within the mid-cap growth equity space, as we identify several companies that enable and potentially benefit from each theme.

I. Reshoring & The Reemergence of Domestic Manufacturing

The reshoring of critical manufacturing activities and industries to the United States started well before President Donald Trump began his second term. Though the administration’s aggressive tariff policies in 2025 accelerated the reshoring movement, broader issues like logistics reliability, cost efficiency, and geopolitical security risks had already propelled reshoring onto corporate agendas.

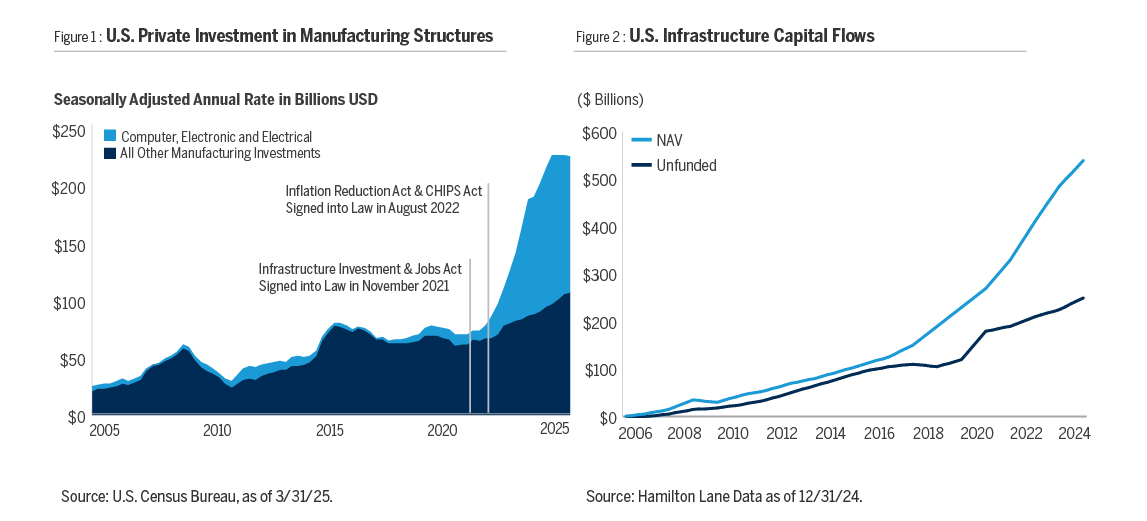

Evidence of reshoring critical manufacturing can be found in Figure 1, which shows a noticeable rise in U.S. private investment in electronic and electrical equipment that coincides with significant legislative incentives passed by Congress (Infrastructure Investment & Jobs Act, followed by the CHIPS & Science Act and the Inflation Reduction Act). These policy measures partially aim to reduce America’s technology dependence on Asia, which manufactures about 70% of global semiconductors compared to just 12% in the U.S. and have resulted in substantial capital flowing into dedicated private infrastructure funds (see Figure 2). Private equity managers, such as

Blue Owl, are allocating this capital toward critical infrastructure projects. These projects include grid modernization, transportation infrastructure, and data center buildouts necessary to handle AI workloads.

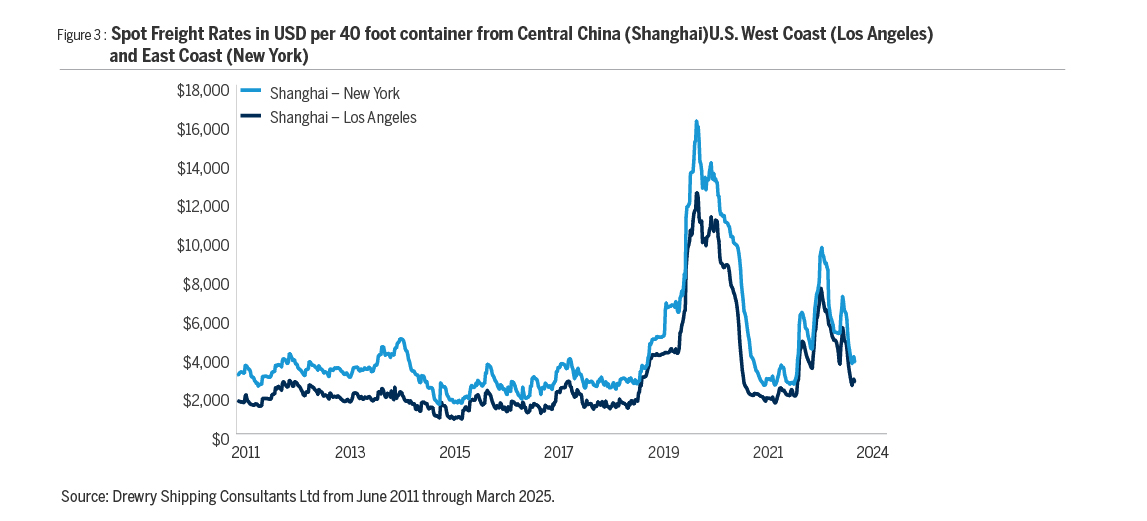

The 2020 COVID-19 pandemic starkly illustrated vulnerabilities inherent in extended international supply chains. Pandemic-driven disruptions led to significant bottlenecks and dramatically elevated ocean freight costs. In 2021, stimulus-fueled demand for imported goods collided with container shortages and port congestion, driving Shanghai-to-New York spot rates significantly higher than their pre-COVID levels (see Figure 3).

A second wave of disruption arose in late 2023 through 2024 due to supply-side shocks. Houthi attacks in the Red Sea and severe drought conditions at the Panama Canal forced ships into extended, costly detours, significantly reducing global shipping capacity. To mitigate anticipated future disruptions, importers front-loaded their orders, exacerbating the shortage of available shipping space and prolonging elevated rates throughout 2024.

The recent escalation of U.S. tariffs on Chinese imports adds further volatility to logistics costs, reinforcing manufacturers' strategic imperative to shorten and stabilize supply chains through reshoring. By relocating operations closer to domestic markets, companies can better insulate themselves against future logistical shocks.

We believe this resurgence in domestic manufacturing activity is generating meaningful opportunities for mid-cap companies linked to the construction and infrastructure sectors. For instance,

United Rentals is experiencing robust growth in long-term construction equipment rentals as non-residential megaprojects gain momentum.

Martin Marietta Materials is benefiting from increasing demand for aggregates and specialty cement—materials typically sourced locally due to high transportation costs—particularly in reshoring-intensive Sun Belt regions like Texas, Georgia, the Carolinas, and Arizona. Further downstream,

GFL Environmental is capitalizing on increased construction debris disposal needs and sustained solid-waste management requirements from reshored manufacturers, such as consumer packaged goods producers (CPG). In our view, these companies collectively provide a comprehensive toolkit—encompassing equipment rentals, essential building materials, and environmental solutions—to support the ongoing expansion of reshoring and domestic manufacturing in America.

II. Industrial Automation

Policy incentives and geopolitical pressures are driving major investments in automation-intensive manufacturing facilities, especially within semiconductor, pharmaceutical and CPG industries. For instance,

Texas Instruments2,

Micron3, and

Intel4 are collectively committing tens of billions of dollars toward building new semiconductor manufacturing plants. Similarly, pharmaceutical giants

Roche5,

Merck6 and

Johnson & Johnson7 are expanding their U.S. presence, establishing large-scale manufacturing sites dedicated to biologics, vaccines, and innovative therapeutics in response to drug shortages, political scrutiny regarding offshore active-ingredient sourcing, and supportive state incentives.

To remain competitive amid high domestic labor costs, CPGs like

Kimberly-Clark and

Procter & Gamble are proactively investing in automation facilities. Kimberly-Clark has committed $2 billion over the next five years to expand U.S. manufacturing capabilities, including an $800 million smart facility in Warren, Ohio, and a $200 million fully automated distribution center in South Carolina. These facilities integrate robotics, AI-driven logistics, and high-density storage solutions to expedite direct shipping processes. Procter & Gamble’s “Supply Chain 3.0” initiative leverages automation to synchronize production data across the supply chain, reducing retailer truck unloading times from 2½ days to just 10 minutes—a striking 99% labor-time reduction. This automation-driven model aims to deliver up to $1.5 billion in annual cost savings and facilitate unattended overnight shifts, currently rolling out across multiple global plants.

9The reshoring of manufacturing operations to the United States has amplified the urgency for automation solutions to offset comparatively high domestic labor costs and address persistent workforce shortages. U.S. manufacturing wages significantly exceed those in markets like Mexico and East Asia, pushing companies to embrace industrial automation to remain competitive.

Several mid-cap companies are strategically positioned to support this reshoring-driven acceleration toward automation. Companies like

Amphenol Corporation provide specialized connectors and sensors integral to automation, robotics, and industrial AI applications, ensuring reliability in highly demanding manufacturing settings. By incorporating numerous sensors on machine tools and robotics throughout a factory, manufacturing companies can leverage their digital twin to analyze operations in real time and significantly improve efficiency (see image 1).

Comfort Systems USA installs advanced HVAC and mechanical solutions essential for maintaining optimal climate control in automated, sensitive environments like semiconductor and pharmaceutical plants. Together, these companies enable vital infrastructure support, facilitating America’s industrial resurgence driven by reshoring and technological innovation.

III. Increased Power Demand

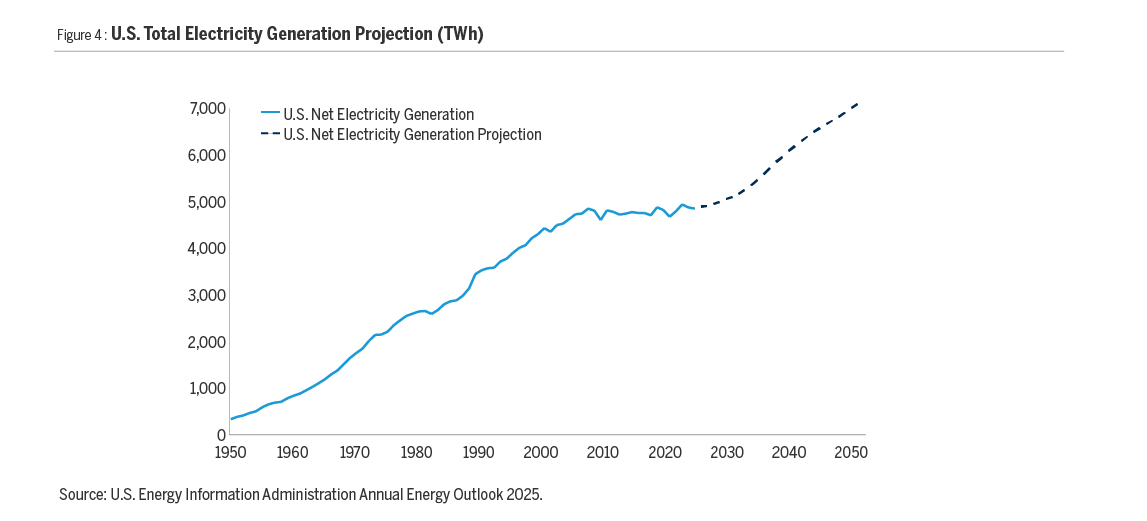

As industrial automation expands, the integration of robotics and AI-driven technologies will lead to a considerable increase in electricity demand. Historically, from 1950 to 2005, U.S. electricity generation expanded significantly, driven by industrialization, suburban development, and widespread adoption of electric appliances, with factories prominently contributing to the surge in power consumption (see Figure 4). However, between 2005 and 2024, demand plateaued as the U.S. shifted toward greater energy efficiency and transitioned to a service-based economy that outsourced heavy industrial production overseas. Today, electricity consumption is projected to rise significantly due to a combination of reshoring, widespread electrification (such as electric vehicles, heat pumps, and industrial robotics), and increasing AI adoption. Illustratively, the International Energy Agency (IEA) forecasts global data center power consumption to more than double, reaching 945 TWh by 2030, predominantly driven by AI inference workloads—with a substantial portion concentrated in the United States.

10

Meeting the electricity needs of these automation-heavy operations requires parallel advances in power infrastructure.

Monolithic Power Systems supplies highly integrated power-management semiconductors that convert and regulate voltage inside data-center racks, factory equipment and EV systems, improving the efficiency and reliability of modern power infrastructure. Within data centers,

Vertiv Holdings Co. specializes in sophisticated thermal management and power systems, employing advanced cooling techniques such as direct-to-chip cooling to effectively dissipate intense heat generated by servers running AI workloads. At the power generation level, independent power producers such as

Talen Energy operate nuclear and flexible natural gas facilities that deliver reliable, cost-effective power supply essential for automation-intensive plants and extensive AI data center operations.

Going Forward

The resurgence of manufacturing and infrastructure investment in America is not a transient policy trend under the Trump administration, but a durable, multi-year realignment shaped by lessons from pandemic-induced vulnerabilities, sustained bipartisan fiscal support, and significant advancements in industrial automation and technology. Within the mid-cap equity space, we are finding compelling, yet underappreciated investment opportunities, many of which are strategically positioned to support—and potentially benefit from—this economic transformation, capturing value at the intersection of cyclical tailwinds and enduring secular growth trends. As reshoring accelerates, industrial automation becomes increasingly widespread, we believe these companies are well positioned to compound faster than the broader U.S. economy over the medium-to-long term. While asset class diversification remains important, we caution that portfolios neglecting mid-cap companies integral to America’s manufacturing revival and infrastructure modernization risk overlooking one of the most underappreciated megatrends in the post-pandemic economic landscape. For long-term investors, we believe allocating to mid-cap growth companies offers a disciplined way to gain exposure to durable, outsized growth potential driven by secular themes that remain “under the radar.”