Innovation, Policy, and Productivity Converge

The United States is in the midst of a business spending boom powered by the convergence of innovation and economic policy, in our view. A historic surge in private capital expenditures is reshaping the country’s industrial landscape, fueled by extraordinary advances in artificial intelligence (AI), the reindustrialization of domestic supply chains, and an unusually supportive policy environment. Together, we believe these forces are driving what may become the most significant capital investment cycle in decades.

The Scale of the Expansion

Private Nonresidential Fixed Investment (PNFI), which is business spending on factories, equipment, software, and research, has reached more than $4.2 trillion annually, representing roughly 14% of U.S. GDP. This category encompasses three primary components:

-

Structures: Physical assets such as factories, warehouses, and data centers.

-

Equipment: Industrial machinery, GPUs, servers, and tools used to produce goods and services.

-

Intellectual Property Products: Software, R&D, and design work that underlie technological innovation.

Taken together, these elements form the backbone of America’s productive capacity. Recent corporate announcements suggest a dramatic acceleration in this capital stock. Announced plans on PNFI have surged to approximately $8.8 trillion in 2025, including Apple’s $600 billion U.S. manufacturing initiative and Project Stargate, a roughly $500 billion AI infrastructure collaboration among SoftBank, OpenAI, and Oracle (see Figure 1), both of which are anticipated to be deployed in stages over the next four years.

These investments reflect a broad reindustrialization of the American economy—one that extends from the digital core of AI computation to the physical infrastructure supporting power, logistics, and advanced manufacturing.

Innovation as the Catalyst

At the center of this expansion is innovation—specifically, the rapid advancement of AI and the relentless demand for computing power that follows. A simple AI query requires roughly ten times more compute than a traditional Google search, and consequently a substantially higher amount of energy. For example, if one were to ask an LLM what the capital of France is, it would be more compute intensive to respond versus simply providing links to information about France. Moreover, an AI query that requires reasoning such as “plan my trip to France for my family of two adults and three children” may use more than 100x the compute or power of a typical Google search. Furthermore, asking an AI agent to book such a trip including airfares, hotels, tours, etc. could use 1000x the compute or power of a Google search (see Figure 2).

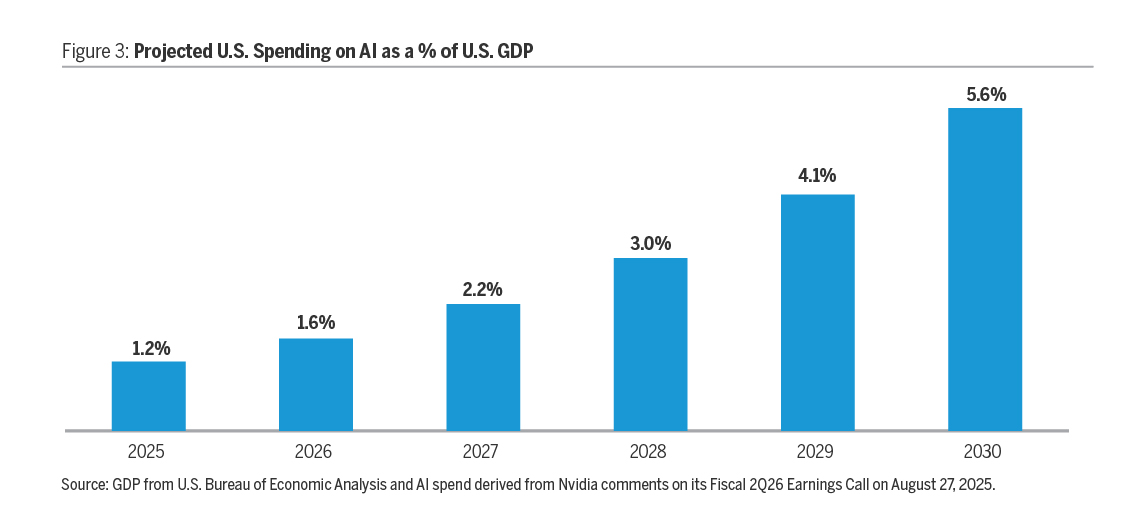

As a result, the scale of the projected U.S. AI infrastructure buildout is immense, drawing comparisons to America’s wartime mobilization during World War II. In 1945 dollars, the United States spent roughly $330 billion on the war effort, equivalent to about $6 trillion in 2025—an amount comparable to projected cumulative U.S. AI infrastructure outlays between 2025 and 2030. Said differently, the scale of AI spending in the U.S. is projected to rise to over 5% of GDP by the end of the decade (see Figure 3).

The AI-driven investment cycle extends far beyond chips and servers. It is catalyzing an ecosystem of data centers, power generation facilities, electrical components, and advanced manufacturing tools—all necessary to sustain the exponential growth in computing workloads.

Increased Power Demand

As the re-industrialization of America accelerates, the operation of AI factories and advanced manufacturing will materially lift electricity demand, in our view. After decades of growth from 1950 to 2005, U.S. electricity demand plateaued as the U.S. shifted toward greater energy efficiency and transitioned to a service-based economy that outsourced heavy industrial production overseas. However, power demand is projected to grow meaningfully going forward (see Figure 4). Increased industrial manufacturing, widespread electrification (e.g., EVs, heat pumps, and robotics) and data centers running intense AI workloads are pushing power needs higher.

The Policy Tailwinds

A rare alignment of trade, fiscal, and monetary policies is reinforcing the investment cycle. Trade policy is encouraging onshoring as companies around the world seek to avoid tariffs by producing in the U.S. The resulting manufacturing revival spans semiconductors, pharmaceuticals, batteries, and clean energy technologies. In our view, this dynamic underscores what we call the “return on proximity”—the economic and strategic advantage companies gain by locating production, innovation, and supply chains closer to end markets. By shortening logistics, mitigating geopolitical risk, and improving quality control, proximity is becoming a powerful source of competitiveness.

Fiscal and regulatory policy have become increasingly supportive of business formation and expansion. Recent legislation and administrative reforms have created powerful incentives for capital spending, including:

- Immediate expensing of equipment, manufacturing structures, R&D, and software, reducing the after-tax cost of investment.

- Tax credits and subsidies for energy independence, semiconductor manufacturing, and domestic production.

- Streamlined permitting and pro-business regulation aimed at accelerating industrial projects.

Monetary policy is likewise contributing to the upturn. Following approximately 100 basis points of Federal Reserve rate cuts in 2024, with additional easing in 2025, the cost of capital is falling at the same time corporate balance sheets remain healthy. Historically, this combination of low borrowing costs and strong corporate liquidity has preceded multi-year upcycles in capital expenditure.

The Broader Economic Impact

The near-term effects of this spending boom are already visible in employment, industrial output, and corporate profitability. New construction tied to semiconductor fabrication, battery production, and data center infrastructure has lifted demand for skilled labor, engineering services, and specialized materials. Power utilities are expanding generation capacity to meet the needs of AI data centers, while logistics providers are investing in automation and robotics to manage higher throughput.

Automation is becoming a defining feature of this cycle. As production returns to the U.S., companies are deploying AI driven manufacturing systems to offset higher labor costs and enhance productivity. Companies are supplying critical components—connectors, sensors, and environmental systems—that make advanced automation possible, while consumer product leaders like Kimberly-Clark and Procter & Gamble are using AI and robotics to synchronize production and distribution networks across facilities.

Beyond the immediate stimulus, the potential productivity gains from this investment cycle could be transformative. Economists have long observed that productivity accelerates when new technologies diffuse through capital formation— when firms not only innovate but also invest in applying those innovations at scale.

Beneficiaries Across Sectors

The investment beneficiaries may extend across the broader economy. Together, these companies form the backbone of America’s next generation of industrial capacity—spanning the physical and digital systems that enable AI innovation, domestic manufacturing, and long-term productivity growth.

- AI chip and connectivity ecosystem leaders such as NVIDIA, Broadcom, and Astera Labs sit at the core of this transformation, providing the computational and networking architecture required to train and deploy AI models at scale.

- Power infrastructure providers, including Vertiv Holdings and Talen Energy, stand to benefit from the expansion of data centers and the rising demand for electricity to support AI workloads.

- Suppliers of advanced components, like Monolithic Power Systems and Amphenol, are enabling greater efficiency and reliability across data, manufacturing, and automation systems.

- Materials and environmental services firms, such as Martin Marietta Materials and GFL Environmental, may participate indirectly as nonresidential projects expand nationwide.

A Foundation for the Future

We are optimistic that this surge in business investment will support near-term economic growth and also lay the foundation for sustained productivity gains. History provides a useful precedent. The massive outlays of World War II produced enduring technological breakthroughs—jet engines, radar, microwave electronics, and early computing—that shaped the post-war economy for decades.

Likewise, today’s investment cycle, combining AI innovation with domestic reindustrialization, may serve as the foundation of a new era of American productivity. The fusion of digital intelligence and industrial capacity—supported by fiscal incentives, lower interest rates, and the clear “return on proximity” from reshoring—suggests that the benefits of this cycle could extend well beyond technology, driving broad-based economic dynamism for years to come.